Real World Assets (RWAs)- Key bridge between decentralized and traditional finance

DeFi provides an immense potential for the untapped possibilities of Real World Assets.

Web 3.0, Blockchain, and RWAs, does that ring any bells? As truly said, “Curiosity is the wick in the candle of learning.” — William A. Ward.

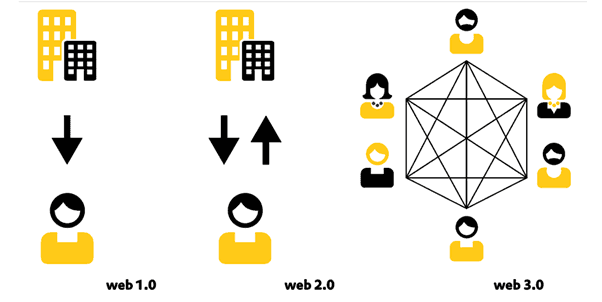

A few years back, to me, it sounded mindboggling. The world is transforming exponentially, which seemed impossible a few decades ago. Web 1.0 and Web 2.0 played a crucial role in the transformation we observe today. We have been surfing the wave of Web 3.0, which has an enormous and infinite potential to shape the world for a better future. Web 3.0 is also known as Semantic Web. It is a progressive iteration of the internet that creates digital information with machine-understandable meaning and context. It has several key features, such as Decentralization, Smart Contracts, Data Ownership and Privacy, and Decentralized Applications (DApps), to name a few. It enables more precise data interpretation, efficient knowledge retrieval, and improved automation of tasks within an interconnected and intelligent web environment.

Since the advent of financial systems, we have established centralized institutions with enormous power to control the entire system. It involves established financial institutions like banks, stock exchanges, and investment firms, as well as regulatory frameworks and intermediaries that facilitate various financial activities such as lending, investment, trading, and payment processing. With the dawn of Web 3.0, it has disrupted almost every sector. This has impacted the world of finance, and it is going through a radical transformation with the use of Blockchain. One such example is Decentralized Finance (DeFi).

“Gradually, decentralized trust will be accepted as a new and effective trust model. We have seen this evolution of understanding before — on the Internet.” Andreas Antonopoulos

Decentralized Finance is a revolutionary movement within the financial sector that leverages blockchain technology to create an open and decentralized ecosystem for various financial activities. Under the umbrella of DeFi, traditional financial services are replicated using smart contracts on blockchain networks, allowing individuals to engage in activities such as lending, borrowing, trading, and earning interest without the need for intermediaries or central authorities and providing the transfer of power to everyone. DeFi platforms operate transparently and autonomously, often resulting in quicker transactions, reduced fees, and increased accessibility to financial services for a global audience.

Integrating RWAs with physical assets — Real World DeFi:

The emergence of Real World Assets marks an evolutionary milestone in the convergence of traditional finance with decentralized technologies. By tokenizing RWAs, the boundaries between physical and digital assets begin to blur, ushering in an era of unprecedented financial opportunities. Tokenization enables fractional ownership, thereby democratizing access to investments that were previously confined to a select few.

Working of RWAs:

To bridge the gap between TradFi and DeFi, RWAs can play a significant role. Real World Assets involve converting physical assets into digital tokens on a blockchain, enabled by a well-designed tokenization protocol. The tokenization of RWAs allows users to bring these off-chain assets onto the blockchain, thereby opening a new realm of possibilities regarding composability and potential use cases. This process enhances accessibility, liquidity, and transparency in financial markets, enabling a broader audience to engage in ownership and investment activities that were traditionally more restricted. From the perspective of Web 3.0, these assets are being brought onto the blockchain to enable fractional ownership, enhance liquidity, and democratize access to investments to the substantial extent of users.

To transfer the power to the users by tokenization, an asset protocol defines the standardized framework regarding how RWAs are represented, tokenized, managed, and transacted on a blockchain. It further provides a structured approach to ensure that the digital tokens representing ownership of RWAs are created, transferred, and managed consistently and securely. The protocol is the foundation for tokenization, allowing for interoperability, transparency, and trust within the digital ecosystem.

Tokenization of RWAs:

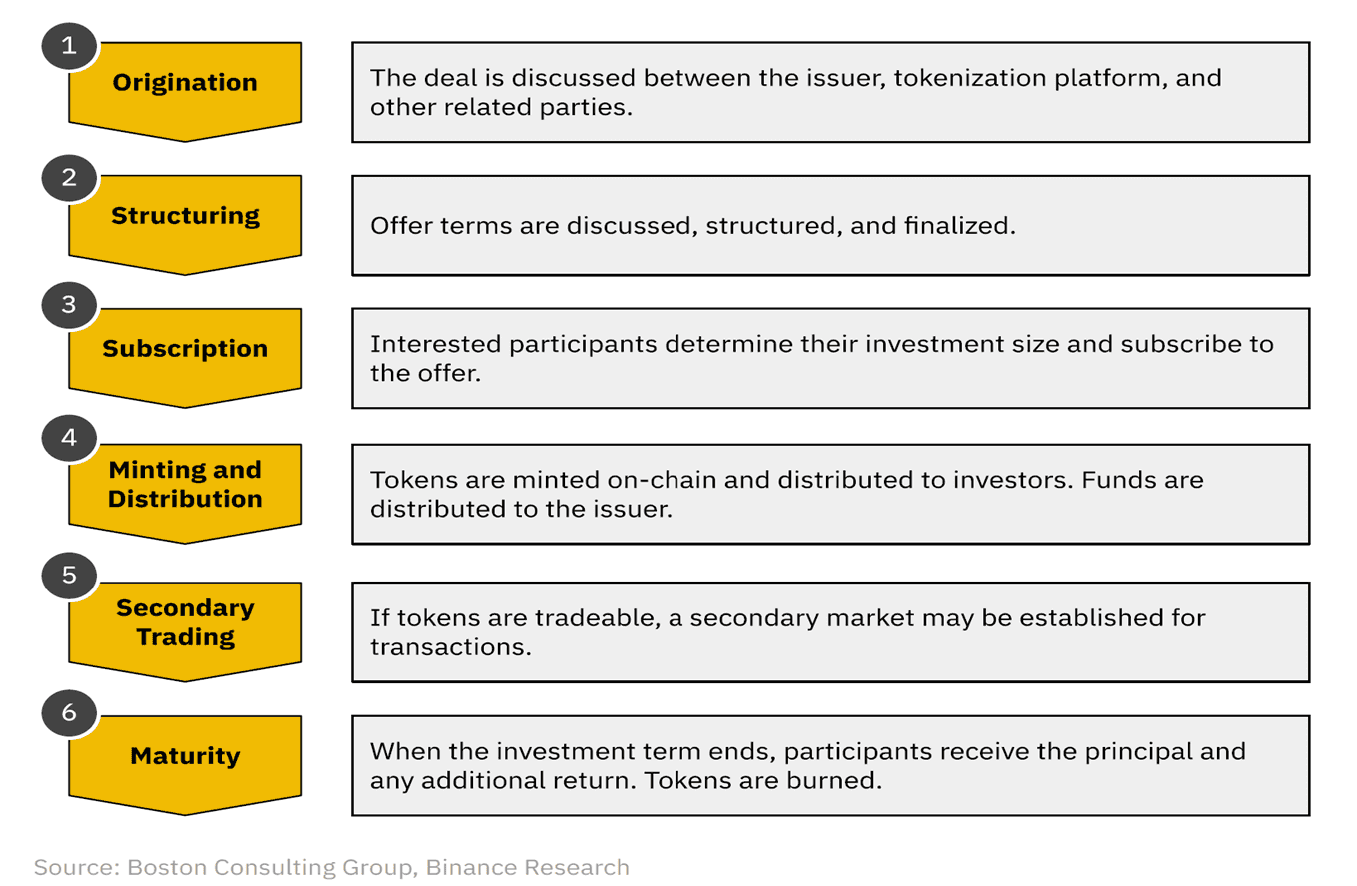

The tokenization process involves transforming real-world assets into digital tokens on a blockchain, enabling fractional ownership and enhanced liquidity. This process leverages blockchain’s secure and transparent characteristics. The exact working principles may vary, but the generic process involves ironing out the deal terms before minting tokenized representations of the asset on-chain.

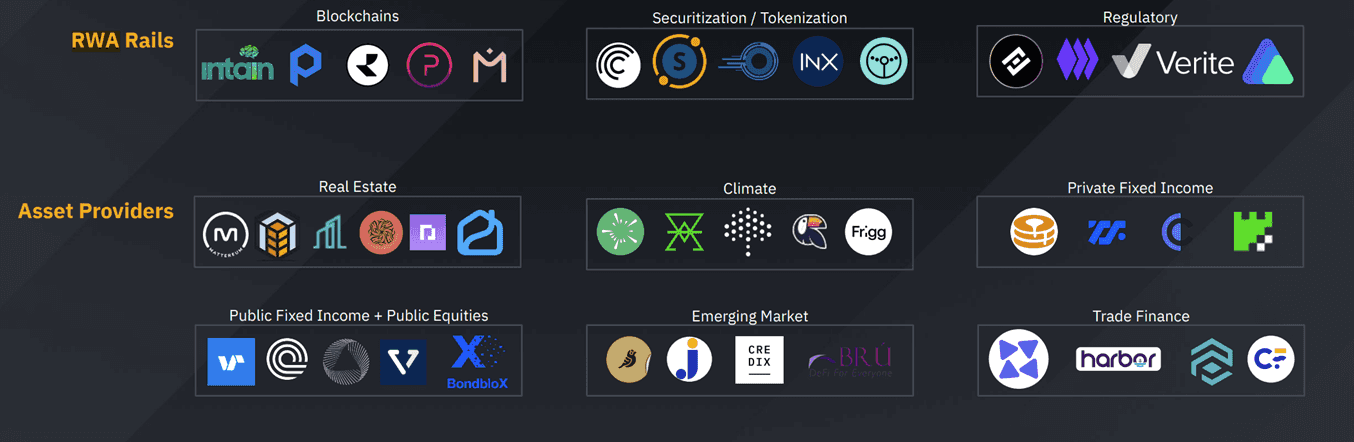

The RWA ecosystem is exceptionally diverse and expanding exponentially as more projects enter the market. Many “asset providers” focus on originating and creating demand for RWAs across various asset classes such as real estate, equities, bonds, collectibles, etc. The figure depicts the vertical overview of the RWA and provides a clear picture to the users.

Advantages of RWAs:

Liquidity Enhancement: Tokenization transforms traditional assets into digital tokens that enable fractional ownership, making it easier to trade on secondary markets. This enhances accessibility and gives investors and users more opportunities to buy or sell.

Accessibility: Tokenization democratizes access to investments that were restricted to deep pockets individuals or institutional investors. Anyone with a basic internet infrastructure can participate in owning fractional shares of valuable assets.

Global Accessibility and Diversification: Digital tokens are easily accessible to a worldwide audience by removing geographical barriers and allowing individuals from the entire globe to invest in assets they would not have accessed before. Tokenization enables investors to diversify their portfolios across different types of assets, reducing risk by spreading investments.

Transparency and Trust: Blockchain’s transparent and immutable nature ensures that all transactions and ownership records are verifiable and tamper-proof. This transparency builds trust among participants, reducing the risk of fraud or disputes.

Automation and cost efficiency: Smart contracts automate various processes, such as dividend distribution or rental payments, reducing administrative overhead and ensuring transaction accuracy. It further reduces the costs associated with intermediaries, paperwork, and administrative tasks, making the investment process more efficient and cost-effective.

Disadvantages of RWAs:

Regulatory Challenges and Security Concerns: The regulatory landscape for tokenized assets is still evolving, and navigating different jurisdictions and compliance requirements can be complex. As blockchain is generally considered secure, tokenization platforms and smart contracts are not immune to vulnerabilities or hacks, potentially leading to losing funds or assets.

Market Volatility and Fragmentation: Tokenization enhances liquidity and can expose assets to higher levels of market volatility due to increased trading activity. The emergence of various platforms and tokenization standards can lead to market fragmentation, making it challenging to create a unified ecosystem.

Educational Barrier: Tokenization introduces a new layer of technology and concepts, requiring participants to understand blockchain, digital wallets, and other technical aspects. Understanding these technical terms and jargon can be daunting for individuals without a computer science or finance background. It requires a lot of effort to get acquainted with.

Valuation Challenges and Exit Strategy: Determining the value of tokenized assets, especially those with unique characteristics, can be challenging and subjective. Many factors include a lack of historical and comparable data, market sentiment, intrinsic value, etc. Exiting an investment in tokenized assets might involve complexities related to selling tokens, finding buyers, and navigating market dynamics.

Current outlook and future trends:

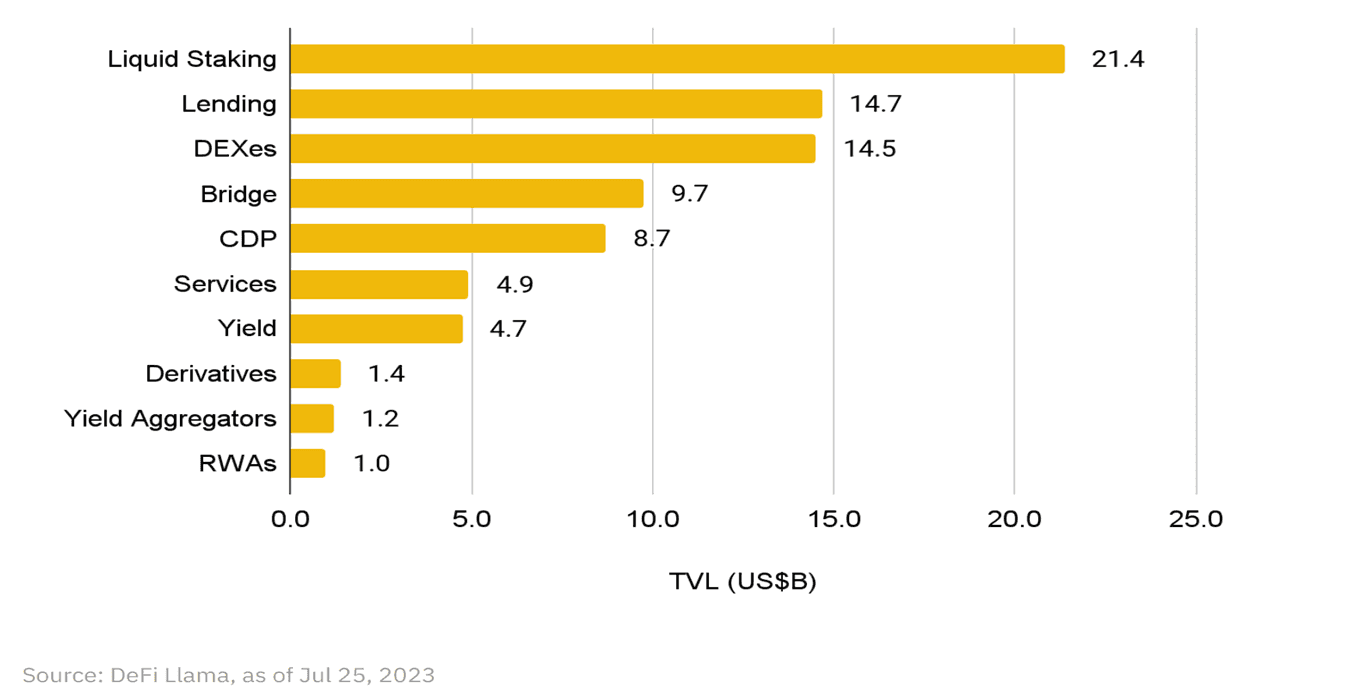

The RWA market is in its infancy and indicates signs of increasing adoption and growing total value locked (“TVL”). Currently, RWAs are the 10th most significant sector in DeFi based on protocols tracked by DeFi Llama, gained a position from 13th place just a couple of weeks ago as of end-June. A significant contributor has been the launch of stUSDT in July, a protocol that allows stakers of USDT to receive yield based on RWAs.

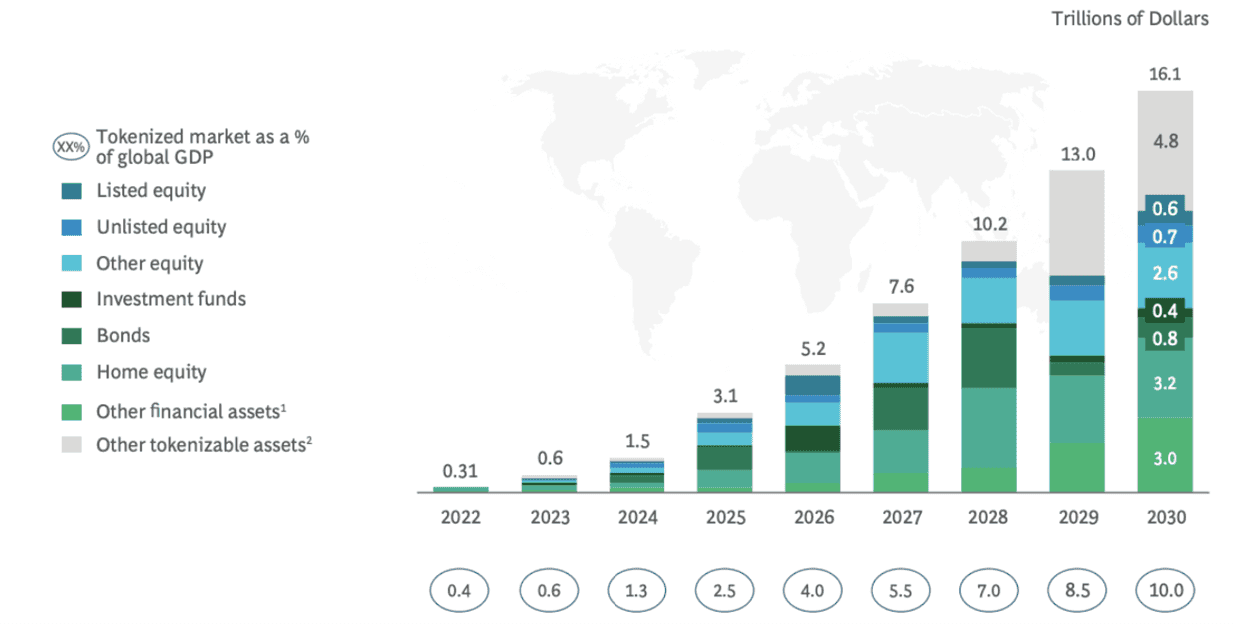

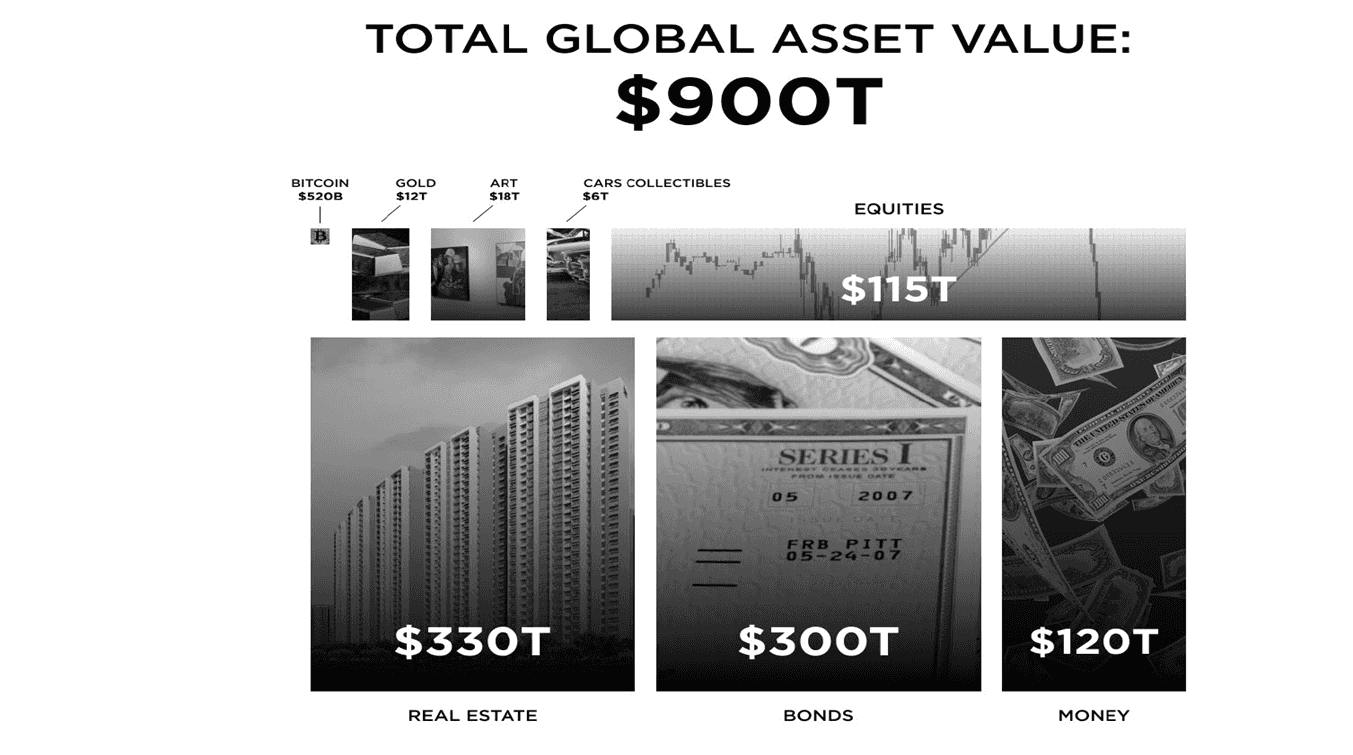

The tokenization of real-world assets (“RWAs”) has continued to gain traction with consistent user adoption and the entrance of prominent institutional players. Coupled with relatively low decentralized finance (“DeFi”) yields, rising interest rates have contributed to the uptake of RWAs, in tokenized treasuries. Investors are effectively lending over US$600M to the U.S. government today via the tokenized treasury market and receiving around a 4.2% annualized yield. Tokenized assets are estimated to be a US$16 trillion market by 2030, with huge potentia for growth and a notable increase from US$310B in 2022. With the present value of a total of US$ 900T, it depicts the future and unfathomable potential of the RWA.

Conclusion:

Finally, the emergence of RWAs and their integration into the Web 3.0 space has provided a profound shift in the financial paradigm. Tokenization and the principles of Real World DeFi can democratize access to wealth, amplify financial inclusion, and reshape the traditional notions of ownership and investment. As the journey continues, the impact on global finance is transformative and helping in the dawn of an era where the benefits of tangible assets are universally accessible, irrespective of geographical or socioeconomic constraints.